How does my mortgage payment work?

Congratulations on your new land! Understanding how your mortgage payments work can make the experience a lot less intimidating. There is a few key terms that you need to know in order for everything else to make sense:

1. Principal – this is the amount of money that you actually borrowed. Every month, a portion of your payment goes towards this balance.

2. Interest – this is the cost of borrowing the money. It’s a calculated as a percentage of your remaining loan balance. It’s important to note that early in your loan, a larger portion of your payment goes towards interest. This is because your principal amount is larger.

3. Taxes – Depending on which subdivision you currently live in, Cayetano might collect property taxes as part of your monthly payment. These funds are held in an escrow account, meaning they are not used for anything other than paying off your property taxes when due on January 31st every year.

Once consistent payments have been made, the overall balance of the loan decreases, which makes the interest shrink. That means more of your payment will go toward the principal amount. Since Cayetano offers on an open contract, you are able to make extra payments towards your loan in order to pay it off sooner. Paying off your mortgage sooner means that ultimately you would pay less interest.

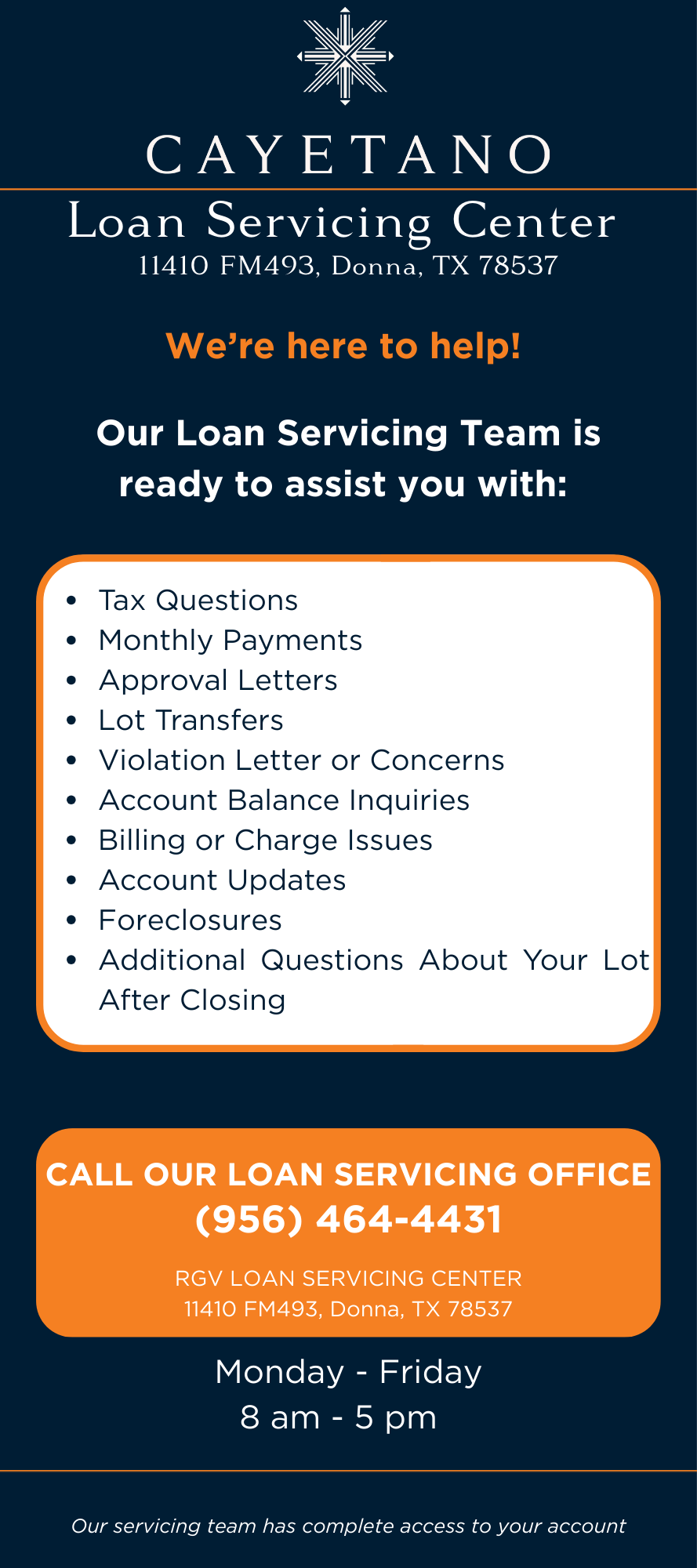

Understanding your mortgage helps you plan smarter and build equity faster. The more you know about where your money is going each month, the more confident you will feel in your investment. Our Loan Servicing Team is always available to help you with any questions that might come up during the lifetime of your loan. The phone number to the Servicing office is: (956)464-4331.

Below is an image with information on what the Loan Servicing Team can help you with.